Sep 14 2018. It was the impetus for the subprime mortgage crisis.

Pin On Stock Market Nerd Stuff

In afternoon trading the Dow Jones Industrial Average.

. The burst of the housing bubble of 2008 was a fact. The nations real-estate market is in disarray. The stock market and housing crash of 2008 had its origins in the unprecedented growth of the subprime mortgage market beginning in 1999.

A trader works on the floor of the New York Stock Exchange on September 15 2008 in New York City. The financial crisis and recession of 2008 and 2009 were serious blows to the US. The 2008 financial crisis is one of the worst economic disasters ever The economy went into recession.

The stock market and housing crash of 2008 had its origins in the unprecedented growth of the subprime mortgage market beginning in 1999. Another reason why 2022 is not the same as 2008 is our inventory levels. To put this into context a typical household spent just 297.

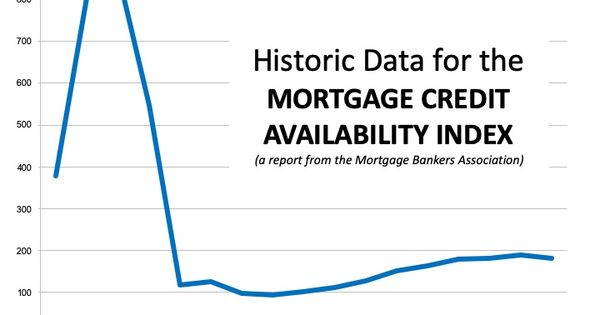

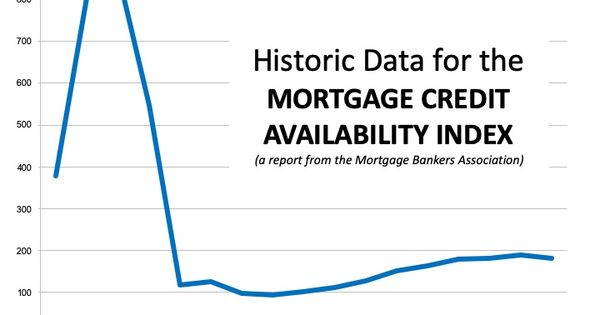

Lenders relaxed their strict lending standards to extend credit to. Among the differences between todays housing market and that of the 2008 housing crash is that lending standards are tighter due to lessons learned and new regulations. The Difference Is in the Equity.

We had about 1400 homes monthly coming to the. Average rents in the top 50 markets have risen 223 while incomes nationally fell 58 in the nine years since 2006. Many of us werent.

Our inventory levels are about 25 of what they were in 2008. In the years leading up to the housing crash just 14 of. The fall in home sales as buyers are put off by soaring house prices is not a sign of an impending market bubble or crash according to Lending Tree.

The United States housing bubble was a real estate bubble affecting over half of the US. What makes the housing crash of 2008 less likely to happen today is that the loans taken out are procured using the correct process. The housing market crashed in 2008 leaving many homeowners in a dire financial situation.

It was the most serious financial crisis since the Great. By August 2007 the Federal Reserve responded to the subprime. The stock market crashed in 2008 because too many had people had taken on loans they couldnt afford.

The first signs came in 2006 when housing prices began falling. The Great Recession began well before 2008. Dont take on more house or debt than you can comfortably afford.

The housing market is the foundation of our economy in the United States. In 2008 when the housing market crashed it nearly brought down the global economy. Todays housing market is very different for a few key reasons.

The financial crisis of 2008 or Global Financial Crisis was a severe worldwide economic crisis that occurred in the early 21st century. So its not always a given that the housing market will be adversely affected during a downturn and certain economic conditions that caused the last crash dont exist today. Economy so it is important to step back and understand what caused them.

02 Jun 2022. Home prices and rents have. Housing prices peaked in early 2006.

Global economic ripple effects. 1 day agoAs some of the factors that contributed to the housing crash of 2008 reemerge many Americans. The housing market crash led to the stock market crash not only in the US which.

It caused the biggest recession since the great depression of. Allie Lehman Death to the Stock Photo 1.

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

4 Quick Reasons Not To Fear A Housing Crash Real Estate Tips Guidance Get A Loan

Here Is The 1 Reason It Is Soooo Difficult To Find You Brooklyn Real Estate Real Estate Information Real Estate Trends

This Is Not 2008 All Over Again The Mortgage Lending Factor Mortgage Real Estate Tips Real Estate Information

Orlando Home Prices Up Nearing 2006 Peak Orlando Business Journal Economic Analysis House Prices Business Journal

The Financial Crisis Flowchart Financial Planning Financial Financial Management

Bearmarket Bearmarketprotection Bubble Dia Diatradesignals Dowjonestradingsignals Housingbubble Nasda Trading Signals Effects Of Inflation Stock Market

Rbc Economic Sentiment Index Signals Sustained S P Rally Ahead Sentimental Business Confidence Chart

The Most Bullish Chart In The World Has A Big Stock Market Crash In The Middle Of It Stock Market Stock Market Crash Marketing

Atlanta Is The Key Signal That The Us Housing Market Is Headed Lower Marketing Housing Market Atlanta

Why Housing Will Crash Again But For Different Reasons This Time Crash Economics Investing

Real Estate Bubble Real Estate Melbourne How To Get Rich Global Real Estate

2008 All Over Again Will The Housing Market Finally Crash 2022 In 2022 New Home Construction Things To Sell House Prices

What Cause 2008 Financial Crisis Google Search In 2021 Stock Market Crash Stock Market Marketing

Uk Housing Market Trends 2013 Property Transactions Mortgages Household Uk Housing Marketing Trends Housing Market

Will A Foreclosure Wave Crash The Housing Market Foreclosures Real Estate Prices Distressed Property

7 Graphs That Show The Real Estate Market Is Back Infographic Real Estate Trends Real Estate Tips Real Estate Advice

5 Simple Graphs Proving This Is Not Like The Last Time Charts And Graphs Graphing Real Estate Tips